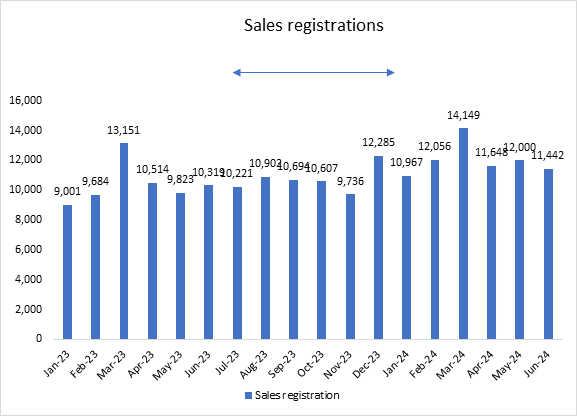

Mumbai Property Registrations Up 11% YoY In June 2024

Mumbai City recorded approximately 11,443 property registrations in June 2024, contributing over Rs 986 crores to the state exchequer

Compared to the same period last year, property registrations have risen by 11 per cent year-on-year (YoY), and revenues from these registrations have increased by 15 per cent YoY. Strong buyer confidence in Mumbai has kept property sales above the 10,000 mark, in the first half of the year. The market has seen consistent yearly growth in registrations for eleven months since August 2023. In June 2024, Mumbai experienced the highest number of property registrations for any June month in the past 12 years. This upsurge can be attributed to rising economic prosperity and a favourable sentiment towards homeownership.

Mumbai property sale registration and government revenue collection

|

Period |

Registration |

YoY |

MoM |

Revenue |

YoY |

MoM |

|

Jun-23 |

10,319 |

4% |

5% |

859 |

17% |

3% |

|

Jul-23 |

10,221 |

-10% |

-1% |

831 |

0.3% |

-3% |

|

Aug-23 |

10,902 |

27% |

7% |

810 |

26% |

-2% |

|

Sep-23 |

10,694 |

24% |

-2% |

1,127 |

54% |

39% |

|

Oct-23 |

10,607 |

26% |

-1% |

835 |

15% |

-26% |

|

Nov-23 |

9,736 |

9% |

-8% |

712 |

4% |

-15% |

|

Dec-23 |

12,255 |

31% |

26% |

932 |

12% |

31% |

|

Jan-24 |

10,967 |

22% |

-11% |

760 |

10% |

-19% |

|

Feb-24 |

12,056 |

24% |

10% |

885 |

-20% |

16% |

|

Mar-24 |

14,149 |

8% |

17% |

1,123 |

-8% |

27% |

|

Apr-24 |

11,648 |

11% |

-18% |

1,058 |

18% |

-6% |

|

May-24 |

12,000 |

22% |

3% |

1,034 |

24% |

-2% |

|

June-24 |

11,443 |

11% |

-5% |

986 |

15% |

-5% |

The average number of registrations in H1 2024 stood above the 12-month average of 2023

While property registrations in the city saw YoY growth in June, the average recorded registrations of 12,044 units in the first six months were notably higher than the twelve-month average of 10,578 units. This indicates the sustenance of Mumbai's residential market strength and the confidence of homebuyers.

Additionally, the average government revenue collection in the first six months of 2024, amounting to Rs 974 crore, was eight per cent higher than the average of Rs 906 crores witnessed in CY 2023. The rise in revenue can be credited to several contributing factors, such as the higher volume and value of properties being registered.

Average Registration numbers in H1 2024 stood above the 12-month average of 2023

“The continuous year-on-year growth in property sale registrations underscores the resilience of Mumbai's real estate market. In the backdrop of higher property prices, home registrations have maintained their momentum, reflecting the market's strong appetite and the confidence buyers have in the country's economic trajectory. This positive trend is expected to persist, driven by strong GDP growth, rising income levels, and a favourable interest rate environment, creating an encouraging atmosphere for potential buyers,” says Shishir Baijal, chairman & managing director, of Knight Frank India.

Properties up to 1,000 sq ft continue to lead in registrations

In June 2024, there was a noticeable increase in the registration of apartments measuring between 500 sq ft and 1,000 sq ft accounting for 46 per cent of all property registrations.

In contrast, apartments measuring up to 500 sq ft made up 36 per cent of the registrations, down from 41 per cent in June 2023. This indicates a clear inclination towards larger apartments, with the share of units up to 500 sq ft witnessing a decline. Apartments measuring 1,000 sq ft and above comprised 15 per cent of the total registrations.

Area-wise breakup of apartment sales

|

Area (sq ft) |

Share June 2023 |

Share June 2024 |

|

Up to 500 |

41% |

36% |

|

500 – 1,000 |

43% |

46% |

|

1,000 – 2,000 |

13% |

14% |

|

over 2,000 |

3% |

4% |

The share of western suburbs has fallen from 58 per cent in June 2023 to 49 per cent in June 2024 while Central Suburbs has recorded a jump in share as compared to June 2023 and has gone from 30 per cent in June 2023 to 42 per cent in June 2024. Central Mumbai saw a contribution of two per cent while South Mumbai recorded a one per cent rise to seven per cent.

Micro-Market wise breakup of apartment sales

|

Micro-market |

Share in June 2023 |

Share in June 2024 |

|

Central Mumbai |

6% |

2% |

|

Central Suburbs |

30% |

42% |

|

South Mumbai |

6% |

7% |

|

Western Suburbs |

58% |

49% |

Source: timesproperty.com

Back to All: News Updates